AVPN recently welcomed new members to our network who are key players in a rapidly growing practice in social/impact investment and strategic philanthropy: Third Sector Capital Partners, IDInsight, KOIS Invest, and more. These members play important roles as structurers, funders, evaluators and conveners of innovative cross-sector social impact funding models, also known as Pay For Success models (PFS) that give rise to Social/Development Impact Bonds (SIB/DIBs). In proportion to AVPN’s total membership of 440+ organisations, SIB/DIB players are still the minority – yet this is belied by the accelerating growth in interest by Asian stakeholders in SIB/DIBs. Is this a sign of increasing adoption of cross-sector funding models that are multi-year and impact-evidence-based? Are the ecosystems in Asia truly ready for these forms of impact funding?

What is “Pay For Success”?

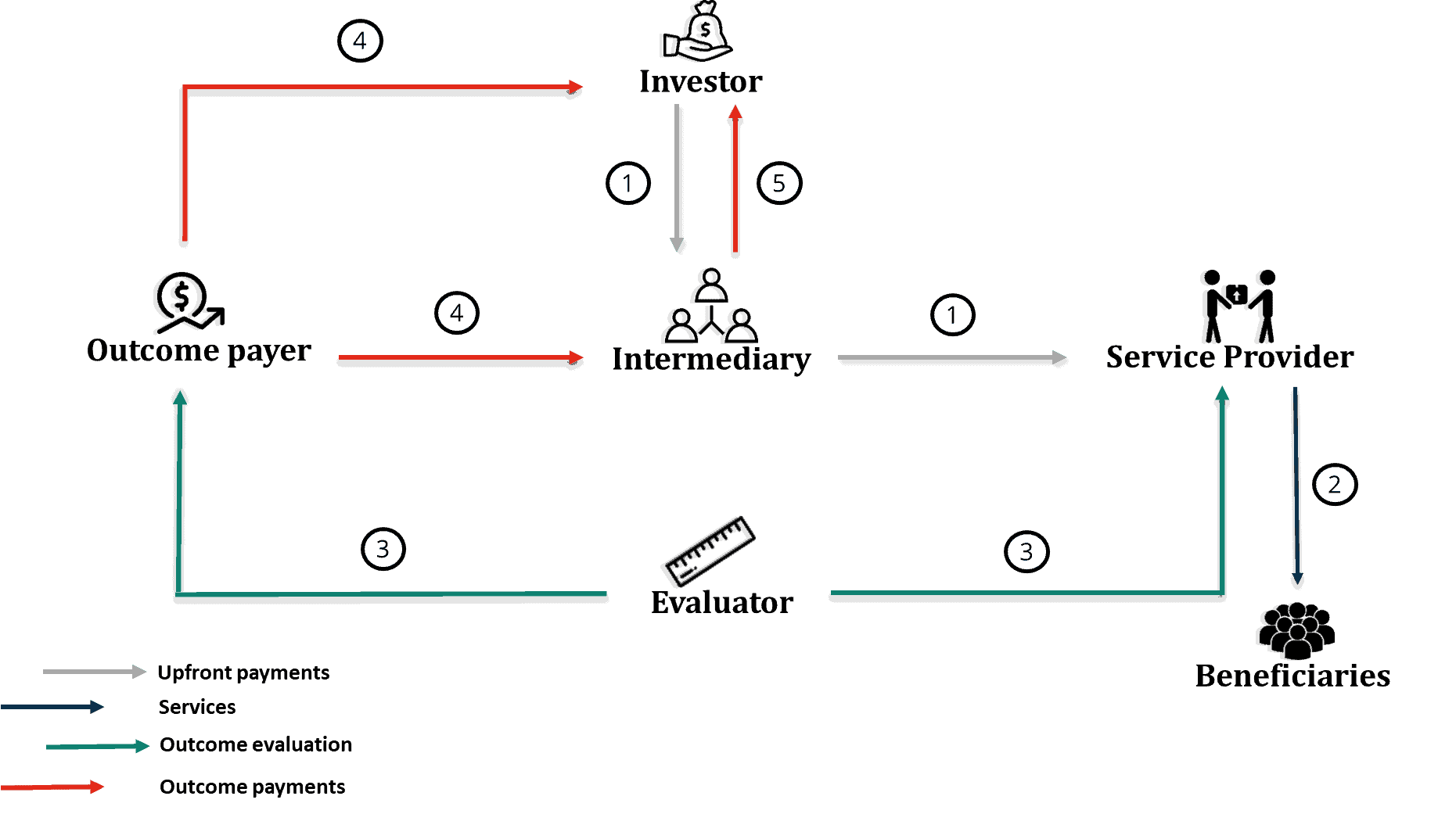

Pay For Success (PFS) models are funding structures where funders, outcome payers, and programme implementers/service providers come together for win-win outcomes. In fact, outcome payers start the ball rolling by specifying a desired outcome, typically more effective or more innovative than current programmes.

Funders, like impact investors, foundations and companies, first provide capital to service provider(s) who have the capability to achieve the desired outcomes (see [1] and [2]). After objective evaluation of the results (see [3]), if the desired outcomes have been achieved, the capital, sometimes with interest, is returned to the funders by the outcome payers (see [4]). PFS models are gaining interest in Asia after its growth in UK and the US, primarily due to the appeal of generating more effective philanthropic and policy outcomes.

Early Movers in Asia: Encouraging Signs of Innovative Public-Private-People Collaboration

This is a brave new space for funders and structurers of PFS models in Asia, as they are the early movers in the region. Although less than 4 years in development – between Japan, Korea, India, Malaysia, Singapore, Thailand, China, Hong Kong, Taiwan – there are no less than 8 PFS models launched and 31 in exploration and development. [1]

As we engaged local policymaker communities and AVPN members through Asia Policy Forum’s workshops, roundtables and policy meetings to understand this trend more deeply, we saw encouraging signs for the growth of innovative funding models for greater impact.

- Across public, private and people sectors, there was proactive cross-sector engagement and commitment to collaboration.

Strong attendance at AVPN roundtables and workshops on PFS models in Singapore and Hong Kong

Strong attendance at AVPN roundtables and workshops on PFS models in Singapore and Hong KongAgencies and policymakers like Japan’s Ministry of Economy, Trade & Industry, Hong Kong’s Efficiency Unit, and Taiwan’s Social Innovation Lab have taken the initiative to host cross-sector workshops and seminars about PFS.

- During these workshops, we heard strong interest and challenging questions raised about readying a culture of evidence-based practice, data and transparency. In Taiwan’s recent workshop, we learned more about their “open government” initiatives and readiness to leverage technology to overcome data challenges; Malaysia’s Social Progress Assessment led to the launch of the Social Outcome Fund, and most recently saw the development of a Social Impact Exchange to encourage transparency of resource matching for impact organisations.

Introductory Workshop to Pay For Success Financing Models in Taiwan

Introductory Workshop to Pay For Success Financing Models in Taiwan - There is also growing legislative and intermediary support for such innovations: Korea is making strides in establishing legal frameworks for Social Value and Social Impact Bonds, supported by its long history of social enterprise legislation. There is growing dialogue between policymakers and intermediary organisations like Third Sector Capital Partners and Pan-Impact Korea to explore opportunities.

- More exciting is the opportunity to learn from the experience of SIB/DIB pilots by empowered states and municipalities, like Seoul, Kobe, Yokohama and Rajasthan. These pilots are diverse in design, not weighed down by the scale of national-level implementation, yet each able to iterate with lessons from earlier efforts.

To delve deeper, AVPN began a case study series of 4 different SIB/DIB that involve our members. The series highlights their similarities/differences, and member insights to the benefits, challenges, preconditions and key success factors. We will be unveiling these case studies officially at the AVPN Conference 2018 on 4-7 June in Singapore. Leading up to the Conference, we are excited to hold an Impact Funders workshop in Kuala Lumpur, Malaysia in late April and a Webinar on the Kobe and Seoul Social Impact Bonds.

Encouraging Beginning for Impact Evidence-based Funding in Asia

After AVPN’s early engagement this year with the policy community, we are energised and inspired by the growth potential of innovative cross-sector impact funding models; the success of recent AVPN workshops and roundtables only add to the momentum. Doubtless each market still has many challenges to overcome and there is more to be learned about successful execution of such structures, yet we are motivated as the building blocks are falling in place for evidence-based impact funding. It is a certainty that Asia will develop its own unique flavour of PFS models, and we invite you to join AVPN in participating, even leading, in their exciting developments.

Add new comment