https://www.unescap.org/events/2021/south-east-asia-policy-dialogue-sust...

https://www.unescap.org/sites/default/d8files/event-documents/Concept%20...

The world continues to face the unprecedented socio-economic impacts of the COVID-19 pandemic, and the Southeast Asian sub-region is no exception. Considerable efforts are needed to not only build back better and recover from the pandemic but also to resume the journey towards the Sustainable Development Goals. Despite the historic amounts of fiscal stimuli introduced by several countries to provide immediate relief, additional spendings will be required for the short and medium-term at the global and national levels. Importantly, the significant policy packages rolled out by Governments may have missed the opportunity to promote low carbon, climate-resilient and green development.

At the 4th Southeast Asia Multi-Stakeholder Forum on the Implementation of the Sustainable Development Goals, held in October 2020, countries expressed the need to address capacity gaps to explore innovative approaches to scale up climate finance. Only a few countries in the subregion (e.g., Indonesia, Singapore, Thailand, and Malaysia) have the capacity to issue green bonds to finance their spending needs, particularly during COVID-19. The high standards and the requirement to have a strong bond issuance capacity are particularly challenging for some countries.

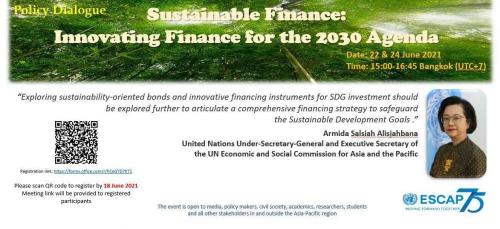

The overall objective of this event is to strengthen regional cooperation for climate and sustainable finance in line with sub-regional priorities of South-East Asia, which include development of sustainable capital markets; adoption of green bond standards; and developing sustainable and social bonds. Session 1 will provide an update on the state of green/SDG-linked bonds in Southeast Asia and highlight ESCAP’s ongoing initiatives to facilitate member States in financing climate-resilient and green development pathways. Session 2 will examine measures that the ASEAN economies can undertake to take advantage of the growing interest and demand of climate and sustainable finance.

This growing interest is encouraging for both the policymakers and investors looking for domestic and international investment opportunities. In particular, the perspective of EU investors and institutions will be discussed on the potential of green/SDGlinked bonds in Southeast Asia. Mobilizing climate and sustainable finance is also important to achieve the 2030 Agenda and recovery from the COVID-19 pandemic. Thus, the objectives of this policy dialogue will include: • Providing a platform for a dialogue among multiple stakeholders to discuss the subregional perspectives and good practices that can help accelerate pursuit of the SDGs and build forward better in the context of the COVID-19 crisis. • Enhancing knowledge of policymakers in South East of Asia innovative financing instrument to promote the issuance of green/SDG-linked bonds. • Outlining a strategic plan for the development of green/SDG-linked bond market in Southeast Asia subregion.

FOR MORE INFORMATION, PLEASE CONTACT

Add new comment