Find here the full scorecard:

https://6000718.fs1.hubspotusercontent-na1.net/hubfs/6000718/PESP_AFR_Re...

Find here article by The Guardian covering the issue: https://www.theguardian.com/business/2022/sep/14/private-equity-dirty-en...

Society cannot afford to let private equity continue to pollute under the shroud of darkness and put people’s retirement at risk. The policymakers and regulators who govern financial markets, as well as private equity’s investors, must require comprehensive disclosures and plans to transition out of fossil fuels.

This report was researched, written, and edited jointly by researchers at Private

Equity Stakeholder Project and Americans for Financial Reform Education Fund.

About Americans for Financial Reform Education Fund

Americans for Financial Reform Education Fund is a nonprofit, nonpartisan

coalition of more than 200 civil rights, community-based, consumer, labor,

small business, investor, faith-based, civic groups, and individual experts. It was

founded in the wake of the 2008 financial crisis and its mission is to fight to

create a financial system that deconstructs inequality and systemic racism and

promotes a just and sustainable economy.

About the Private Equity Stakeholder Project

The Private Equity Stakeholder Project is a nonprofit organization with a

mission to identify, engage, and connect stakeholders affected by private

equity with the goal of engaging investors and empowering communities,

working families, and others impacted by private equity investments.

Private markets hold billions in energy investments with minimal public visibility, but with the accelerating climate crisis causing $152.6 billion in disaster damage in2021 in the U.S. alone, the need for transparency and a rapid transition to a cleanenergy economy has never been more urgent.

The growth in private markets is transforming finance, but large players likeprivate equity are hardly regulated and exempt from most financial disclosures “leaving regulators with more blind spots concerning the risks buyout firms mightpose.”

Private equity firms have invested over $1 trillion in energy since 2010, andthus have taken on a significant role in propelling the climate crisis.

Institutional investors that provide private equity firms with capital for investmentface significant climate risks through exposure to private equity’s existing portfolioof polluting assets, as well as financial and transition risks as society seeks todecrease greenhouse gas emissions and move to a clean energy economy. Ten of the largest private equity buyout firms had at least 80 percent of theirenergy portfolios in fossil fuels, as of October 2021.

As public markets attempt toshed assets, private equity asset managers have repeatedly acquired them andoperated these fossil fuel assets out of the public eye and beyond the oversight offinancial regulators.

The billions of dollars private equity firms have deployed todrill, frack, transport, store, refine fossil fuels, and generate energy, stand in starkcontrast to what climate scientists and international policymakers have calledupon to align our trajectory to the 1.5 degrees Celsius warming scenario.

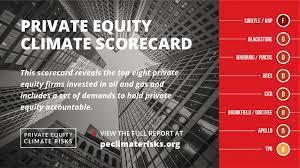

This report reveals the top eight private equity buyout firms invested in oil and gasand includes a set of demands to hold private equity accountable for the risks in their fossil fuel portfolios, the harmful impacts they have on the environment and frontline communities, and the need to execute a just energy transition.7The scorecard assesses and ranks the fossil fuel portfolios and progress toward an energy transition of eight of the largest private equity firms.8 These eight firmsoversee a combined $3.6 trillion in assets under management.9 The Carlyle Group ranked last among its peers, earning an F. In 2020, Carlyle-owned power plants emitted millions of tons of carbon dioxide, and the firm continues to demonstrate inadequate progress toward transitioning away from fossil fuels and reducing climate risks. Other bad actors include Warburg Pincus, KKR, Brookfield, Ares,

Apollo, and Blackstone Group which all earned Ds. Private equity firm TPG earned

a B, having a comparatively smaller portfolio of fossil fuels and having made some

progress relative to its peers toward clean energy transition.

In order for these firms, and the private equity industry broadly, to demonstrate

commitment to a just energy transition, this report outlines a set of five primary

demands:

1. Align with Science-Based Climate Targets To Limit Global Warming To 1.5⁰C

2.Disclose Fossil Fuel Exposure, Emissions and Impacts

3.Report Portfolio-Wide Energy Transition Plan

4.Integrate Climate And Environmental Justice

5. Provide Transparency On Political Spending And Climate Lobbying

Society cannot afford to let private markets continue to pollute under the shroud

of darkness. The institutional investors whose retirement capital is at risk, the

communities harmed by fossil fuel extraction and impacted by climate change,

and the public deserve transparency and a rapid transition away from dirty energy

from the private equity industry.

The policymakers and regulators who govern

financial markets, as well as private equity’s investors, must require comprehensive

disclosures and transition plans.

Add new comment